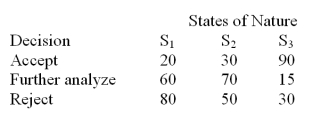

The quality control manager for the NKA Inc.must decide whether to accept (alternative 1),further analyze (alternative 2),or reject (alternative 3)the shipment (lot)of incoming material.The historical data indicates that there is 30% chance that the lot is poor quality (S1),50% chance that the lot is fair quality (S2),and 20% chance that the lot is good quality (S3).Assume the following payoff table is available.The values in the payoff table are in thousands of dollars.  Based on historical data,if the lot is poor quality,40% of the items are defective.If the lot is fair quality 22% of the items are defective.If the lot is good quality,10% of the items are defective.The quality control manager inspects one unit from a recent shipment.

Based on historical data,if the lot is poor quality,40% of the items are defective.If the lot is fair quality 22% of the items are defective.If the lot is good quality,10% of the items are defective.The quality control manager inspects one unit from a recent shipment.

After inspecting it,he determines that the unit is defective.If the inspected item is defective,determine which alternative action the quality control manager should choose.

Definitions:

Prime Rate

The interest rate that banks charge their most creditworthy customers, often used as a benchmark for other loans.

Risk Profile

An assessment of an entity's or individual's willingness to take risks, as well as the threats to which they are exposed.

Financial Risk

The potential for financial loss in an investment or business operation.

Unexpected Price Changes

Variations in the price of securities that occur without prior warning, often due to unforeseen events.

Q5: A decision-maker's expected _ is based upon

Q5: What are the specific contributions to human

Q7: Why do some analysts describe Max Weber's

Q8: Which of the following statements about nonparametric

Q16: The quality control manager for the NKA

Q22: A multiple linear regression analysis involving 45

Q26: The sign test is a test about

Q48: Which discipline defines itself as "the systematic

Q49: The _ procedure works the same way

Q75: Parametric tests such as F and t