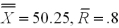

Suppose that  and R charts are based on subgroups of size four are being used to monitor the tire diameter size of a new radial tire manufactured by a tire company.The

and R charts are based on subgroups of size four are being used to monitor the tire diameter size of a new radial tire manufactured by a tire company.The  and R charts are found to be in statistical control with

and R charts are found to be in statistical control with  inches.A histogram of the tire diameter measurements indicates that distribution of these measurements is approximately normally distributed. If the tire diameter specifications are 50 inches 1 inch,is the process capable of meeting the specifications?

inches.A histogram of the tire diameter measurements indicates that distribution of these measurements is approximately normally distributed. If the tire diameter specifications are 50 inches 1 inch,is the process capable of meeting the specifications?

Definitions:

Investment Interest Expense

The amount of interest paid on debt incurred for investments, allowing taxpayers to deduct it under certain conditions.

Gross Investment Income

The total income generated from various investment sources before any deductions or taxes are applied.

Medical Expense Deduction

A tax deduction allowed for unreimbursed medical expenses that exceed a certain percentage of the taxpayer's adjusted gross income.

Dependent

Dependent is a person, typically a child or elderly family member, whose support and maintenance are provided by another, qualifying the supporting individual for certain tax benefits.

Q2: Drawing on the ideas of Lenski,Marx,Weber,and Durkheim,cite

Q7: How is Canadian sociology distinct from American

Q38: A sign test is a test of

Q49: The quality control manager for the NKA

Q52: Below is a partial multiple regression ANOVA

Q53: A unit that fails to meet specifications

Q54: Paasche index more accurately provides a year-to-year

Q73: Below is a partial multiple regression computer

Q90: An application of the multiple regression model

Q93: How well a process is able to