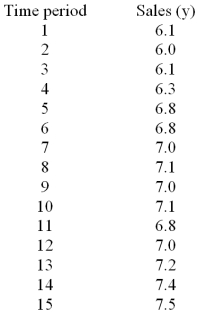

Consider the regression equation  = 6.04 + 0.10(t) and the data below.

= 6.04 + 0.10(t) and the data below.  Compute the residual (error term) for period 8.

Compute the residual (error term) for period 8.

Definitions:

PEG Ratio

A stock valuation metric that measures the price-to-earnings ratio (P/E) of a stock divided by its earnings growth rate.

Growth Rate

The rate at which an economic variable, such as the Gross Domestic Product (GDP), a company's profits, or an investment's value, increases over a specified period of time.

Market Capitalization Rate

The expected return on an investment in the market, often used in the valuation of stocks and to determine a company's cost of equity.

PVGO

Present Value of Growth Opportunities; a model that estimates the value of a firm's shares excluding its current earnings, focusing on future growth.

Q2: The Wilcoxon signed rank test is also

Q3: Explain the debate over the causes of

Q37: The range of feasible values for the

Q45: Which of the following is a violation

Q45: The _ statistic is used to test

Q64: Consider the following partial computer output

Q71: When we assess the worth of sample

Q73: Consider the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1737/.jpg" alt="Consider

Q122: Given the following data <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1737/.jpg" alt="Given

Q128: The linear regression trend model was applied