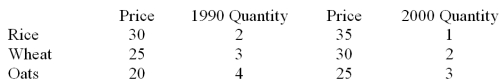

Use the following information for the three grains.  Calculate the Laspeyres index.

Calculate the Laspeyres index.

Definitions:

Risk-Free Rate

The theoretical return on an investment with no risk of financial loss, often represented by the yield on government bonds.

Portfolio Expected Worth

The projected value of a portfolio, considering the potential returns of the investments within it over a specific timeframe.

Alpha

A performance measure indicating the excess return of an investment relative to the return of a benchmark index or risk-free rate.

Risk-Free Rate

The return on an investment with no risk of financial loss, often represented by government bonds.

Q1: Describe trends in the Canadian labour force

Q4: Define feminism.Describe the three main types of

Q7: How has the nature of work in

Q10: If a process is only influenced by

Q37: In a multiple regression mode if the

Q42: The graph of the prediction equation obtained

Q61: The alternatives 1 and 2 in the

Q80: In 25 samples of 100 units each,75

Q86: Consider the 3X2 contingency table below. <img

Q133: Consider the quarterly production data (in thousands