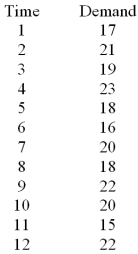

Consider the following data:

Use simple exponential smoothing with = 0.2.and determine the forecast error for time period 1.

Definitions:

Debt-Equity Ratio

A measure of a company's financial leverage, calculated by dividing its total liabilities by shareholders' equity.

Times Interest Earned

A ratio that measures a company's ability to meet its debt obligations by comparing its income before interest and taxes to its total interest expenses.

Debt to Equity

A financial metric showing the comparative amount of debt and shareholders' equity utilized to fund a company's assets.

Price/Earnings

A valuation ratio of a company's current share price compared to its per-share earnings, used to assess if a stock is over or undervalued.

Q12: An experiment was performed on a certain

Q25: An experiment consists of 400 observations,and four

Q49: The Wilcoxon rank sum test is a

Q49: The quality control manager for the NKA

Q62: The Durbin-Watson test statistic ranges from:<br>A)-4 to

Q88: The _ criterion for choosing among alternative

Q98: In simple regression analysis,if the correlation coefficient

Q100: A data set with 7 observations

Q138: _ index is most useful if the

Q139: For a given data set,specific value of