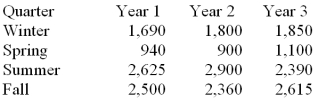

Consider the following set of quarterly sales data given in thousands of dollars.  The following dummy variable model that incorporates a linear trend and constant seasonal variation was used: y (t)= B0 + B1t + BQ1(Q1)+ BQ2(Q2)+ BQ3(Q3)+ Et

The following dummy variable model that incorporates a linear trend and constant seasonal variation was used: y (t)= B0 + B1t + BQ1(Q1)+ BQ2(Q2)+ BQ3(Q3)+ Et

In this model there are 3 binary seasonal variables (Q1,Q2,and Q3).

Where

Qi is a binary (0,1)variable defined as:

Qi = 1,if the time series data is associated with quarter i;

Qi = 0,if the time series data is not associated with quarter i.

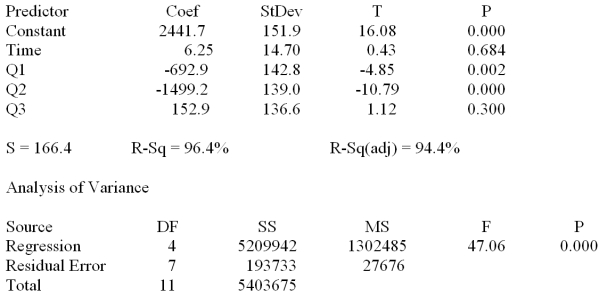

The results associated with this data and model are given in the following MINITAB computer output.

The regression equation is

Sales = 2442 + 6.2 Time - 693 Q1 - 1499 Q2 + 153 Q3  Provide a managerial interpretation of the regression coefficient for the variable "time."

Provide a managerial interpretation of the regression coefficient for the variable "time."

Definitions:

Deferred Tax Liability

This is a tax obligation that a company owes but can pay at a future date due to timing differences between its financial accounting and tax filing.

Deferred Tax Asset

An accounting asset representing the amount of taxes payable in future periods due to deductible temporary differences and carryforwards.

Capital Cost Allowance

A tax deduction in some tax systems for businesses, representing depreciation on capital assets.

Straight-Line Depreciation

A procedure for distributing the expense of a physical asset equally over its operational lifetime on an annual basis.

Q9: Assume that the following data set is

Q15: A U.S.based internet company offers an on-line

Q29: If the Durbin-Watson statistic is less than

Q32: In the multiplicative decomposition method,the centered moving

Q39: A member of the state legislature has

Q41: When we carry out a chi-square test

Q50: R<sup>2</sup> is defined as:<br>A)Total variation/explained variation<br>B)Explained variation/total

Q54: A multiple linear regression analysis involving 45

Q81: Two coffee-vending machines are studied to determine

Q86: A multiple regression analysis with 20 observations