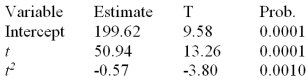

Consider a time series with 15 quarterly sales observations.Using the quadratic trend model the following partial computer output was obtained.

State the two-sided null and alternative hypothesis to test the significance of the t2 term.

Definitions:

Security Market Line

A representation in the Capital Asset Pricing Model (CAPM) that displays the risk versus expected return of the market at any given time.

Beta Coefficient

A measure of a stock's volatility or risk relative to the overall market.

Market Risk Premium

The extra return expected by investors for holding a risky market portfolio instead of risk-free securities.

Risk-free Interest Rate

The theoretical return on investment with zero risk of financial loss, typically associated with government bonds.

Q2: The Wilcoxon signed rank test is also

Q6: Apply the structural-functional and social-conflict approaches to

Q6: The _ test is a nonparametric counterpart

Q32: In the multiplicative decomposition method,the centered moving

Q76: In a multiple regression model with 4

Q84: Five years ago,the average starting salary

Q86: If the multiple coefficient of determination that

Q94: A manufacturing company produces part 2205 for

Q96: Below is a partial multiple regression computer

Q134: A simple linear regression model is an