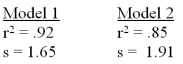

For the same set of observations on a specified dependent variable two different independent variables were used to develop two separate simple linear regression models.A portion of the results is presented below.  Based on the results given above,we can conclude that:

Based on the results given above,we can conclude that:

Definitions:

Strike Price

The predetermined price at which the holder of an option can buy (in the case of a call) or sell (in the case of a put) the underlying asset or security.

Foreign Exchange Gain

A financial benefit that occurs when the value of foreign currencies increases compared to the home currency, affecting transactions or holdings in foreign currencies.

Dollar Value

The monetary worth or value of something expressed in terms of the U.S. dollar.

Settlement Date

The day on which a trade or transaction must be finalized, with the transfer of the asset and payment completed between buyer and seller.

Q8: The rejection of a true null

Q11: Regression Analysis <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1737/.jpg" alt="Regression Analysis

Q35: Which of the following time series forecasting

Q43: The chi-square goodness of fit test for

Q53: For a hypothesis test about a population

Q81: A manufacturer of windows produces one type

Q92: When the assumption of _ - residuals

Q102: Which one of the following procedures is

Q106: The simple linear regression (least squares method)minimizes:<br>A)The

Q129: When we test H<sub>0</sub>: p<sub>1</sub>- p<sub>2</sub>