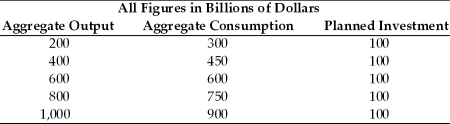

Refer to the information provided in Table 8.4 below to answer the questions that follow.

Table 8.4

-Refer to Table 8.4.At an aggregate output level of $200 billion,the unplanned inventory change is

Definitions:

Tax Burden

The total amount of tax levied on an individual or entity, indicating the actual economic impact of taxation on wealth.

Tax Imposed

A financial charge or levy placed by a government on an individual or an entity to fund public expenditures.

Buyer Pays

A pricing term indicating that the purchaser is responsible for the cost of goods, shipping, and any additional expenses associated with the purchase.

Tax Incidence

Describes how the burden of a tax is distributed between buyers and sellers, depending on the relative elasticities of supply and demand.

Q1: When using an ES,it is very difficult

Q5: If taxes depend on income and the

Q6: When creating customer invoices,the person responsible can

Q12: In the integrated process,under which of the

Q21: Refer to Table 9.1.At an output level

Q41: Since 1970,the U.S.economy has experienced 2 periods

Q57: In a business cycle,a peak represents the

Q84: Which of the following increases the real

Q90: The equation for GDP using the expenditure

Q125: If the GDP deflator next year is