4.2 Supply and Demand Analysis: An Oil Import Fee

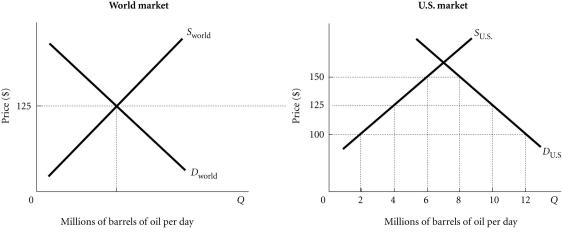

Refer to the information provided in Figure 4.4 below to answer the questions that follow.  Figure 4.4

Figure 4.4

-Refer to Figure 4.4. If the United States levies no taxes on imported oil, which of the following would occur?

Definitions:

Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price within a certain time frame.

Transactions Costs

Expenses incurred when buying or selling goods or services, including the costs of trading financial instruments.

Upper Bound

The highest possible value or limit that a variable, function, or sequence can reach in a given context.

Market Value

The ongoing cost for buying or selling an asset or service within a market platform.

Q3: When supply is fixed,price is supply determined.

Q30: During recessions,the number of discouraged workers _

Q49: Suppose that video game discs are a

Q51: If planned aggregate expenditures are $400 billion,consumption

Q53: Anyone 16 years of age or older

Q68: A dividend is<br>A)a promissory note issued by

Q90: When a country's exports of goods are

Q95: In the circular flow diagram,the different payments

Q116: Related to the Economics in Practice on

Q120: GDP measured in base year prices is