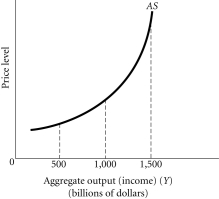

Refer to the information provided in Figure 12.1 below to answer the questions that follow.

Figure 12.1

Figure 12.1

-Refer to Figure 12.1.At aggregate output levels above $1,500 billion,firms in this economy are most likely experiencing

Definitions:

Floatation Expenses

The costs associated with issuing new securities in the market, including underwriting, legal, and registration fees.

Book Value

The net value of a company's assets found on its balance sheet, calculated by subtracting liabilities from the total assets.

Market Values

The current prices at which assets, securities, commodities, or services can be bought or sold in a marketplace, emphasizing the plural to encompass a range of values across various markets.

WACC

Weighted Average Cost of Capital; a calculated average of the cost of equity and the cost of debt that a company uses to finance its operations, weighted based on the proportion of each finance source in the company's capital structure.

Q9: The unemployment rate is the fraction of

Q16: Refer to Figure 14.7.Suppose the economy is

Q16: A decrease in nominal aggregate output will

Q55: The Bank of Red Oak has $2

Q75: Intel Corporation,a major manufacturer of microchips,saw the

Q81: The unemployment rate will never be zero

Q95: Of the tools available to the Fed

Q131: If discouraged workers were counted as unemployed,then

Q138: Which of the following would NOT be

Q141: Refer to Figure 14.3.Assume that the productivity