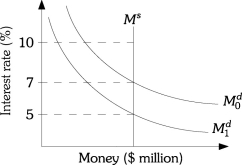

Refer to the information provided in Figure 11.6 below to answer the questions that follow.

Figure 11.6

Figure 11.6

-Refer to Figure 11.6.The demand for money curve will shift from to if

Definitions:

Direct Write-off Method

A method of accounting for bad debts where specific uncollectible accounts receivable are directly written off against income at the time they are deemed to be uncollectible.

Net Income

The profit of a company after all expenses, including operating costs, taxes, and interest, have been deducted from total revenues, indicating financial performance.

Total Assets

The sum of all assets, both current and non-current, owned by a company, representing the total resources it has at its disposal.

Aging of Accounts Receivable Method

An accounting technique used to estimate the amount of receivables that are unlikely to be collected, based on the length of time they have been outstanding.

Q1: Refer to Figure 13.2.Firms respond to an

Q2: Economic policies are effective at changing output

Q6: If the Fed buys securities on the

Q9: If wages adjust fully to price increases

Q42: If money demand falls,then the interest rate

Q48: When the interest rate rises,bond values<br>A)rise.<br>B)fall.<br>C)are unchanged

Q50: In a binding situation,the interest rate is

Q97: The multiple by which total deposits can

Q131: The Phillips curve depicts the relationship between<br>A)output

Q134: When you pay $8 for salad you