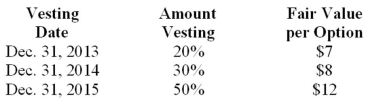

Red Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2013, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  What is the compensation expense related to the options to be recorded in 2014?

What is the compensation expense related to the options to be recorded in 2014?

Definitions:

Marginal Revenue

The additional income received from selling one more unit of a good or service.

Industry Supply Curve

A graphical representation showing the total quantity of a good or service that producers in an industry are willing and able to supply at different price levels.

Marginal Cost Curves

A graphical representation showing how the cost of producing one more unit of a good varies with the quantity of the good produced.

AVC

Average Variable Cost, which is the total variable costs divided by the quantity of output produced.

Q10: Due to an error in computing depreciation

Q17: Prior service cost is expensed immediately using:<br>A)U.S.GAAP.<br>B)IFRS.<br>C)Both

Q47: Which of the following would not be

Q50: Paul Company had 100,000 shares of common

Q52: In its 2013 income statement, WME reported

Q73: Mandatorily redeemable preferred stock is reported as

Q77: On December 31, 2012, Brisbane Company had

Q119: Amounts held in cash equivalent investments must

Q157: What was the average exercise price per

Q179: When preferred stock is purchased by the