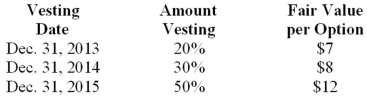

Green Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2013, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2014?

Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2014?

Definitions:

Term

A specified period of time during which certain conditions or agreements apply, or the definition of a concept or expression in specific contexts.

Q12: In February 2013, Despot declared cash dividends

Q14: When one enters a $50,000 credit entry

Q22: The par value of shares issued is

Q24: The purchase of treasury stock is:<br>A)Reported as

Q64: Olsson Corporation received a check from its

Q67: At December 31, 2013, Hansen Corporation had

Q74: All of the following may qualify as

Q82: Noncash assets received as consideration for the

Q140: The changes in account balances for Allen

Q159: The shareholders' equity of Green Corporation includes