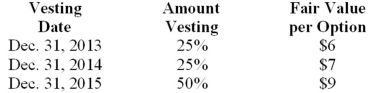

Yellow Company is a calendar-year firm with operations in several countries. At January 1, 2013, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $30. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Yellow prepares its financial statements in accordance with International Financial Reporting Standards, what is the compensation expense related to the options to be recorded in 2014?

Assuming Yellow prepares its financial statements in accordance with International Financial Reporting Standards, what is the compensation expense related to the options to be recorded in 2014?

Definitions:

Total Output

The total quantity of goods or services produced by an economy or a firm within a specific period.

Marginal Product

The additional output produced by adding one more unit of a specific input, holding all other inputs constant.

Fixed Cost

Costs that do not vary with the level of production or sales, such as rent or salaries.

Hail Insurance

A type of insurance policy specifically designed to protect crops from hail damage.

Q5: The tax benefit of a net operating

Q21: GAAP regarding accounting for income taxes requires

Q35: Horrocks Company granted 180,000 restricted stock awards

Q43: Cal Cookie Company (CCC) has 100 million

Q44: Which of the following differences between financial

Q47: Pension data for Sam Adams Inc. include

Q57: Inflation and unemployment<br>A)are the focus of normative

Q60: Which of the following is not one

Q66: Mattson Company receives royalties on a patent

Q91: What is the difference between a stock