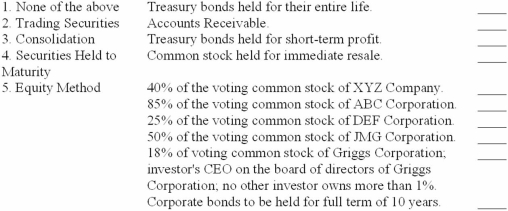

Indicate (by number) the way each of the investments listed below usually should be accounted for under U.S. GAAP based on the information provided.

Definitions:

Income Tax Decrease

A reduction in the rate at which individuals or corporations are taxed on their income, potentially leading to increased disposable income and consumption.

Federal Deficit

The amount by which a government's expenditures exceed its tax revenues.

High Income Earners

Individuals or entities that receive income significantly above the average for their region or country, often subject to higher tax rates.

Sovereign

A supreme ruler, especially a monarch, or relating to a nation's independent authority and right of self-governance.

Q43: MullerB Company's employees earn vacation time at

Q49: Revenue associated with gift card sales should

Q68: What is Nu's gross profit ratio if

Q69: Both fair values and subsequent growth of

Q86: A company that prepares its financial statements

Q103: What is the carrying value of the

Q109: Donated assets are recorded at:<br>A)Zero (memo entry

Q109: Sox Corporation purchased a 40% interest in

Q118: Which of the following is a contingency

Q130: On July 1, 2013, Clearwater Inc. purchased