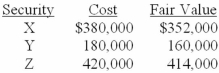

Hobson Company bought the securities listed below during 2012. These securities were classified as trading securities. In its December 31, 2012, income statement Hobson reported a net unrealized loss of $13,000 on these securities. Pertinent data at the end of December 2013 is as follows:  What amount of loss on these securities should Hobson include in its income statement for the year ended December 31, 2013?

What amount of loss on these securities should Hobson include in its income statement for the year ended December 31, 2013?

Definitions:

Current Ratio

An indicator of a company's financial health, showing its capability to settle obligations due within a year by comparing its short-term assets to its short-term liabilities.

Accrued Liabilities

Liabilities recorded on the balance sheet that represent expenses that have been incurred but not yet paid.

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered and invoiced but not yet paid for.

TIE Ratio

A financial performance indicator that shows a company's capacity to cover its interest expenses with its current earnings, highlighting its financial health and stability.

Q5: Required:<br>1. Calculate the amount to be recorded

Q11: Required:<br>Determine the gain or loss that Health

Q30: When bonds are sold at a premium,

Q36: The three factors in cost allocation of

Q43: On January 1, 2013, Salvatore Company leased

Q58: Required:<br>What amount of interest expense will Health

Q102: The cost of customer premium offers should

Q111: What is the point of the last

Q113: Jaycom Enterprises has invested its excess cash

Q135: Ordinarily, the proceeds from the sale of