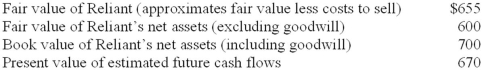

Kingston Corporation has $95 million of goodwill on its books from the 2011 acquisition of Reliant Motors. At the end of its 2013 fiscal year, management has provided the following information for its required goodwill impairment test ($ in millions) :  Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

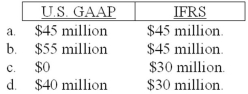

Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

Definitions:

Buyer Pays

A term indicating that the purchaser is responsible for the cost of shipping and insurance during transportation of goods.

Monetary Unit Assumption

An accounting assumption that requires that financial reports be expressed in a single monetary unit, or currency.

Economic Data

Statistical information reflecting the condition of an economy, such as GDP, employment rates, and inflation, used for analysis and policy-making.

Total Assets

The sum of everything of value owned by a business, including cash, securities, equipment, and real estate.

Q3: The cost of promotional offers should be

Q28: The rate of interest that actually is

Q68: The most common type of liability is:<br>A)One

Q74: Distinguish between:<br>(a) Convertible and callable bonds.<br>(b) Serial

Q100: GG Inc. uses LIFO. GG disclosed that

Q109: In 2013, the internal auditors of Blooper

Q119: Funzy Cereal includes one coupon in each

Q126: When an investor owns 20% to 50%

Q131: Assume Gibson Company is an equal partner

Q138: During 2013, Largent Enterprises purchased stock as