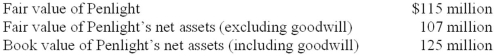

In 2011, Quasar Ltd. acquired all of the common stock of Penlight Laser for $124 million. The fair value of Penlight's identifiable tangible and intangible assets totaled $205 million, and the fair value of liabilities assumed by Quasar was $95 million. Quasar performed a required goodwill impairment test at the end of its fiscal year ended December 31, 2013. Management has provided the following information:  Required:

Required:

1. Determine the amount of goodwill that resulted from the Penlight acquisition.

2. Determine the amount of goodwill impairment loss that Quasar should recognize at the end of 2013, if any.

3. If an impairment loss is required, prepare the journal entry to record the loss.

Definitions:

Inventory Holdings

The quantity of goods and materials on hand that are available for sale or for use in production processes.

Q3: On July 1, 2013, Jekel & Hyde

Q41: Cash equivalents do not include:<br>A)Money market funds.<br>B)High

Q52: Providing a monetary rebate program for purchasing

Q54: How do U.S. GAAP and International Financial

Q60: Under IAS No. 39, investments for which

Q66: The main difference between perpetual and periodic

Q92: Clark's Chemical Company received customer deposits on

Q100: GG Inc. uses LIFO. GG disclosed that

Q123: Cash that is restricted and not available

Q146: Required:<br>Compute depreciation for 2013 and 2014 and