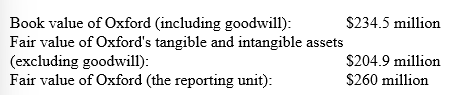

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Definitions:

Diploid Chromosome Number

The total number of chromosomes in a diploid cell, which includes two sets of chromosomes, one from each parent.

Gamete

A mature haploid male or female germ cell which is able to unite with another of the opposite sex in sexual reproduction to form a zygote.

Sister Chromatids

Identical copies of a chromosome that are connected by a centromere and separated during cell division.

Nuclear Envelope

The double membrane structure that encloses the nucleus of a cell, separating its contents from the cytoplasm.

Q2: Assuming that the exchange lacks commercial substance,

Q15: In applying the LCM rule, the inventory

Q28: The table below contains data on depreciation

Q62: During the year, L&M Leather Goods sold

Q85: Costs incurred after discovery of a natural

Q88: Meca Concrete purchased a mixer on January

Q93: Under IFRS, the term "probable" indicates a

Q101: Robertson Inc. prepares its financial statements according

Q113: In Case A, Pensacola would record the

Q131: The factors that need to be determined