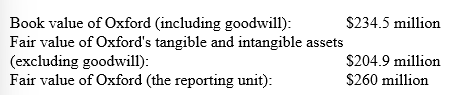

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Assume the same facts as above, except that the fair value of Oxford (the reporting unit) is $225 million.

Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Definitions:

Blue-Collar Workers

Employees who perform manual labor, often in manufacturing, construction, and maintenance fields, typically requiring physical skill and effort.

Wealth Distribution

Wealth Distribution is the statistical distribution of assets among a population, often a subject of economic studies regarding inequality and economic health.

Sunset Businesses

are industries or enterprises in decline, facing reduced demand or obsolescence, often due to technological advancements or changes in consumer preferences.

Clear-Cut

A forestry practice where all the trees in an area are uniformly cut down, often leading to ecological disruptions and loss of habitat.

Q7: Kline Company refinanced current debt as long-term

Q18: The average accumulated expenditures for 2014 by

Q30: On March 30, 2013, Calvin Exploration purchased

Q44: What entry would Cherokee make on November

Q45: Accounts receivable are normally reported at the:<br>A)Present

Q74: On October 31, 2013, Simeon Builders borrowed

Q75: Cortez Associates purchased a debt investment that

Q80: When you use an aging schedule approach

Q100: Cash equivalents would include investments in marketable

Q165: On January 1, 2013, Nana Company paid