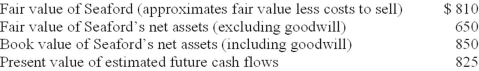

Kentfield Corporation has $260 million of goodwill on its book from the 2010 acquisition of Seaford Shipping. At the end of its 2013 fiscal year, management has provided the following information for a required goodwill impairment test ($ in millions):  Required:

Required:

Assuming that Seaford is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, determine the amount of goodwill impairment loss that Kentfield should recognize according to U.S. GAAP and International Financial Reporting Standards.

Definitions:

Allergic Reactions

Immune system responses to a normally harmless substance, ranging from mild symptoms like itching or sneezing to severe conditions like anaphylaxis.

IgE

refers to Immunoglobulin E, a class of antibodies associated with allergic reactions.

IgA

An antibody known as Immunoglobulin A is essential for the protective functions within mucous membranes.

IgD

A class of antibodies that play a role in the immune system's response to antigens, mainly found on the surface of B cells.

Q4: The average days inventory for ATC (rounded)

Q4: On January 3, 2013, Michelson & Sons

Q30: On March 30, 2013, Calvin Exploration purchased

Q50: Calculation of revised annual amortization:

Q59: Rice Industries owns a manufacturing plant in

Q85: Costs incurred after discovery of a natural

Q133: Required:<br>Compute depreciation for 2013 and 2014 and

Q142: The physical life of a depreciable asset

Q153: Assuming a constant tax rate of 40%,

Q175: Jeremiah Corporation purchased securities during 2013 and