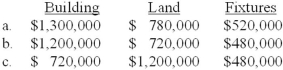

Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum price of $2,400,000. The building was completely furnished. According to independent appraisals, the fair values were $1,300,000, $780,000, and $520,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be:

Definitions:

Self-disclosure

The act of revealing personal, private information about oneself to others, which can enhance intimacy and trust in relationships.

Self-disclosure Patterns

The manner in which individuals share personal information, thoughts, and feelings with others, which can vary widely among different people and contexts.

Active Listening Practices

Techniques that involve fully concentrating, understanding, responding, and then remembering what is being said in a conversation.

Nonverbal Cues

Are communicative actions or signals that don't involve words, often used to convey feelings or intentions.

Q1: On March 15, 2013, Ellis Corporation issued

Q51: A distinguishing characteristic of intangible assets is

Q65: Using the sum-of-the-years'-digits method, depreciation for 2014

Q73: When using the gross profit method to

Q80: Statutory depletion is the maximum amount of

Q81: Amortization of capitalized computer software costs is:<br>A)Either

Q83: The FASB's required accounting treatment for research

Q86: Required:<br>Compute depreciation for 2013 and 2014 and

Q97: Explain the reason that Halliburton indicates that

Q150: When a product or service is delivered