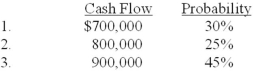

Schefter Mining operates a copper mine in Wyoming. Acquisition, exploration, and development costs totaled $8.2 million. Extraction activities began on July 1, 2013. After the copper is extracted in approximately six years, Schefter is obligated to restore the land to its original condition, including constructing a park. The company's controller has provided the following three cash flow possibilities for the restoration costs:  The company's credit-adjusted, risk-free rate of interest is 5%, and its fiscal year ends on December 31.

The company's credit-adjusted, risk-free rate of interest is 5%, and its fiscal year ends on December 31.

Required:

1. What is the initial cost of the copper mine? (Round computations to nearest whole dollar.)

2. How much accretion expense will Schefter report in its 2013 income statement?

3. What is the carrying value (book value) of the asset retirement obligation that Schefter will report in its 2013 balance sheet?

4. Assume that actual restoration costs incurred in 2019 totaled $860,000. What amount of gain or loss will Schefter recognize on retirement of the liability?

Definitions:

Guidance

Support or advice provided to help someone make decisions, solve problems, or understand situations more clearly.

SWOT Analysis

A strategic planning tool used to identify and understand Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning.

Time Constraints

Limitations or restrictions on the amount of time available to complete a task or activity.

Inconsistent Time Management Skills

A variation in the ability to effectively organize, prioritize, and allocate one's time to tasks, often leading to decreased productivity or increased stress.

Q2: Changes in the estimates involved in depreciation,

Q4: The average days inventory for ATC (rounded)

Q14: Canliss Mining uses the replacement method to

Q32: A deferred annuity is one in which

Q41: The purpose of ceilings and floors in

Q46: Under IAS No. 39, which is not

Q82: Tiger Inc. adopted dollar-value LIFO on January

Q83: The FASB's required accounting treatment for research

Q101: Frasquita acquired equipment from the manufacturer on

Q132: In its 2013 annual report to shareholders,