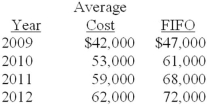

Orlando Company has used the average cost method for inventory valuation since it began business in 2009, but has elected to change to the FIFO method starting in 2012. Year-end inventory valuations under each method are shown below:  Required:

Required:

How would Orlando reflect the change in accounting principle in its financial statements (ignore income taxes)?

Definitions:

Fixed Manufacturing Cost

Expenses that do not change with the level of production, such as rent for factory premises, salaries for permanent staff, and depreciation of equipment.

Manufacturing Overhead Cost

Expenses related to the production process that are not directly tied to a specific product, including utilities, depreciation, and salaries for production supervisors.

Period Costs

Costs that are expensed in the period they are incurred, not directly tied to the production of goods, such as selling, general, and administrative expenses.

Financial Reporting

The process of disclosing financial data and information about a company's performance, financial position, and cash flows, typically in the form of financial statements.

Q4: On January 3, 2013, Michelson & Sons

Q11: Watson Company purchased assets of Holmes Ltd.

Q41: Cash equivalents do not include:<br>A)Money market funds.<br>B)High

Q65: Over the life of a particular account

Q74: Notsofast Inc. acquired land for $500,000 on

Q81: To the nearest thousand, estimated ending inventory

Q82: Dreamworld's average accumulated expenditures for 2013 was:<br>A)$300,000.<br>B)$450,000.<br>C)$525,000.<br>D)$600,000.

Q103: If an available-for-sale investment is sold for

Q105: In 2012, Lake would recognize realized gross

Q118: Costa Co. has the following cash balances