The following information comes from the 2010 Occidental Petroleum Corporation annual report to shareholders:

NOTE 4 INVENTORIES

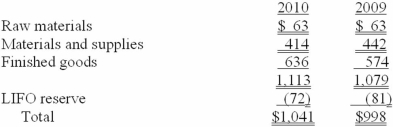

Net carrying values of inventories valued under the LIFO method were approximately $177 million and $175 million at December 31, 2010 and 2009, respectively. Inventories in continuing operations consisted of the following: ($ in millions)  The LIFO reserve indicates that inventories would have been $72 million and $81 million higher at the end of 2010 and 2009, respectively, if Occidental Petroleum had used FIFO to value its entire inventory.

The LIFO reserve indicates that inventories would have been $72 million and $81 million higher at the end of 2010 and 2009, respectively, if Occidental Petroleum had used FIFO to value its entire inventory.

Required:

If Occidental Petroleum had used FIFO to value its entire inventory how would its 2010 pre-tax income be affected?

Definitions:

Security Interest

A legal claim or right granted to a creditor over the borrower's assets as a security for the repayment of a loan.

Repossessed Collateral

Assets that have been taken back by the lender from the borrower, usually due to default on a loan.

Security Interest

A security interest is a legal claim or entitlement provided to a lender or creditor over the borrower's assets, serving as collateral for the repayment of a loan or obligation.

Attached

Pertaining to property law and commercial transactions, it refers to the legal process by which a security interest is formally linked to specific assets, making it enforceable against third parties.

Q12: Property, plant, and equipment and finite-life intangible

Q14: Hazelton Manufacturing prepares a bank reconciliation at

Q28: The table below contains data on depreciation

Q63: Compound interest includes interest earned on interest.

Q69: A note receivable Mild Max Cycles discounted

Q72: On August 15, 2013, Willis Inc. acquired

Q93: GHI Company will issue $2,000,000 in 8%,

Q122: Using the double-declining balance method, depreciation for

Q130: Use of the percentage-of-completion method is dependent

Q132: According to International Financial Reporting Standards, biological