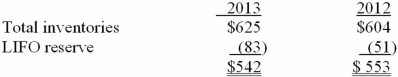

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

Inventories ($ in millions):  The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2013.

The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2013.

Required:

1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2013, adjusting entry to record the cost of goods sold adjustment.

2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2013 fiscal year?

Definitions:

Packaging

The materials and methods used to protect, transport, and present goods for sale.

Thermometer Strip

A temperature-sensitive strip that displays the current temperature by changing color or revealing numerical values.

Southwestern Motif

A design theme characterized by features typical of the American Southwest, often including desert landscapes, native patterns, and warm, earthy colors.

Implementation Plan

A detailed outline of strategies, activities, timelines, and responsibilities to execute a project or strategy effectively.

Q40: 2013 amortization: $3,000,000 ÷ 10 = $300,000

Q44: What entry would Cherokee make on November

Q56: In Dinty's adjusting entry for bad debts

Q78: Fellingham Corporation purchased equipment on January 1,

Q83: In December of 2013, XL Computer's internal

Q90: Murgatroyd Co. purchased equipment on January 1,

Q107: O'Hara Links Products sells a product that

Q122: On January 1, 2012, RAY Co. adopted

Q143: At December 31, 2014, Rigsby would report

Q172: In 2013, Chicago Construction began work on