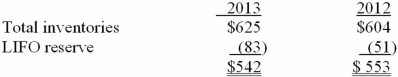

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

Inventories ($ in millions):  The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2013.

The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2013.

Required:

1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2013, adjusting entry to record the cost of goods sold adjustment.

2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2013 fiscal year?

Definitions:

Vicarious Learning

A learning process where individuals learn by observing the actions and outcomes of others, rather than through direct experience.

Insight Learning

The process of learning how to solve a problem or do something new by applying what is already known.

Conditioning

A process of behavior modification by which a subject comes to associate a desired behavior with a previously unrelated stimulus.

Reinforcement

In behavioral psychology, a consequence that will strengthen an organism's future behavior whenever that behavior is preceded by a specific antecedent stimulus.

Q2: What is the correct entry to record

Q12: For each posted entry in the Allowance

Q24: Collection of accounts receivable that previously have

Q39: As of December 31, 2013, Amy Jo's

Q52: Z-Mart appropriately uses the installment sales method

Q62: Briefly explain the financial reporting required when

Q102: Frasquita acquired equipment from the manufacturer on

Q117: The loss would appear in the income

Q122: On January 1, 2012, RAY Co. adopted

Q169: The following footnote appeared in a recent