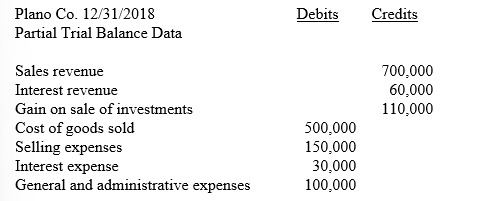

Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 30%.

-Required: Prepare a multiple-step income statement with earnings per share disclosure.

Definitions:

Liability Account

An accounting record that tracks the money owed by a business to creditors, lenders, and suppliers, part of the company's liabilities.

Direct Write-Off Method

This accounting practice writes off bad debts directly against income at the time they are determined to be uncollectible, bypassing any allowance account.

Allowance for Doubtful Accounts

This is an estimation of the amount of receivables that a company does not expect to actually collect, reflecting potential losses due to customers' inability to pay.

Uncollectible

Uncollectible refers to debts or receivables that are deemed to be impossible to collect, often resulting in a write-off by the business.

Q11: A firm's comprehensive income always:<br>A)Is the same

Q37: International accounting standards use the term provision

Q50: Davenport Inc. offers a new employee a

Q66: With an annuity due, a payment is

Q69: A note receivable Mild Max Cycles discounted

Q93: Altoid Co.'s current ratio. Round your answer

Q100: A future economic benefit owned or controlled

Q124: The purpose of closing entries is to

Q129: Which of the following is not a

Q197: When the right of return exists and