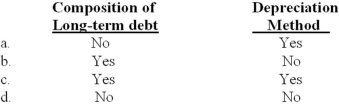

Which of the following would be disclosed in the summary of significant accounting policies disclosure note?

Definitions:

Ending Inventory Overstatement

This occurs when the reported amount of inventory at the end of a period is higher than its actual value, which can distort financial statements.

Cost Basis

The original value or purchase price of an asset or investment for tax purposes, adjusted for dividends, splits, and returns of capital.

Lower-of-Cost-or-Market

An accounting principle requiring inventory to be recorded at either its cost or its market value, whichever is lower.

FIFO

A method of inventory valuation where goods first purchased or produced are assumed to be sold or used first, standing for "First In, First Out".

Q9: Janson Corporation Co.'s trial balance included the

Q11: Guido Properties owes First State Bank $60

Q38: When a company sells land for cash

Q49: HHF's long-term debt to equity ratio equity

Q74: The company's credit-adjusted risk-free rate of interest

Q84: The criteria for determining which items comprise

Q89: The balance sheet reports:<br>A)Net income at a

Q98: Reconciliation between net income and comprehensive income

Q156: An obligation that involves an existing condition

Q210: Wiggins would estimate the transaction price as