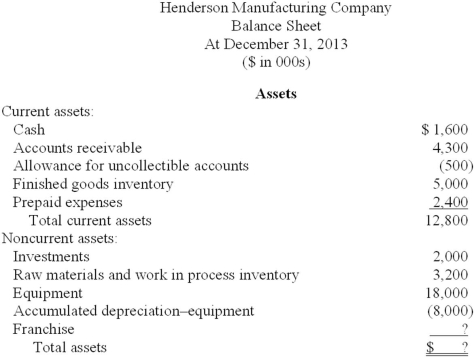

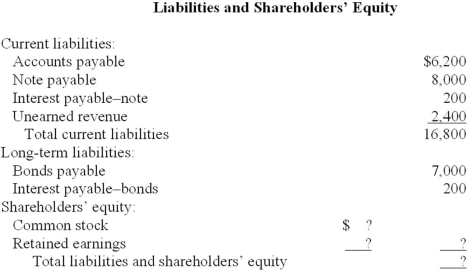

As controller for Henderson, you are attempting to reconstruct and revise the following balance sheet prepared by a staff accountant.

Additional information ($ in 000s):

Additional information ($ in 000s):

1. Certain records that included the account balances for the franchise and shareholders' equity items were lost. However, a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.5. That is, total liabilities are 150% of total shareholders' equity. Retained earnings at the beginning of the year was $4,300. Net income for 2013 was $2,500 and $800 in cash dividends were declared and paid to shareholders.

2. The investments represent treasury bills purchased in December that mature in January. These are considered cash equivalents.

3. Interest on both the note and the bonds is payable annually.

4. The note payable is due in annual installments of $800 each.

5. Unearned revenue will be earned equally over the next 18 months.

6. The common stock represents 500,000 shares of no par stock authorized, 300,000 shares issued and outstanding.

Required:

Prepare a complete, corrected, classified balance sheet.

Definitions:

Supply Partnership

A long-term relationship between a buyer and a supplier characterized by mutual cooperation, shared risks, and investments to achieve joint value creation.

Mutually Beneficial Objectives

Objectives or goals set in a collaborative context that provide positive outcomes or advantages to all involved parties.

Ultimate Consumer

The end user of a product or service, who purchases it for personal use and not for resale or further processing.

Reciprocity

A mutual exchange of privileges or services between two parties where each benefits from the agreement.

Q14: Jose wants to cash in his winning

Q25: Required:<br>Prepare a 2013 single, continuous statement of

Q57: Compute net income for the first year

Q58: The Rink membership is one separate performance

Q60: Compute net income for the first year

Q70: Prepare journal entries to record the following

Q101: A sale on account would be recorded

Q117: Grover,Inc. Grover,Inc.purchased a crane at a cost

Q123: Dowling's average inventory balance for 2013 is

Q138: The liability for a premium offer estimated