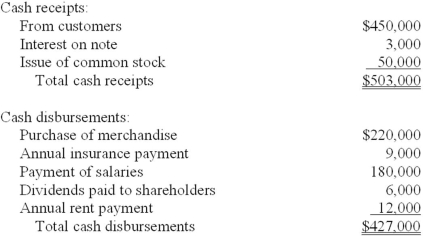

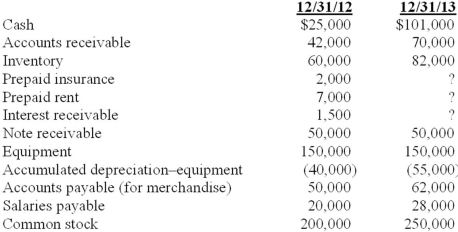

Raintree Corporation maintains its records on a cash basis. At the end of each year the company's accountant obtains the necessary information to prepare accrual basis financial statements. The following cash flows occurred during the year ended December 31, 2013:  Selected balance sheet information:

Selected balance sheet information:  Additional information:

Additional information:

1. On June 30, 2012, Raintree lent a customer $50,000. Interest at 6% is payable annually on each June 30. Principal is due in 2016.

2. The annual insurance payment is made in advance on March 31.

3. Annual rent on the company's facilities is paid in advance on September 30.

Required:

1. Prepare an accrual basis income statement for 2013 (ignore income taxes).

2. Determine the following balance sheet amounts on December 31, 2013:

a. Interest receivable

b. Prepaid insurance

c. Prepaid rent

Definitions:

Relatively Elastic

Refers to a scenario in which the demand or supply for a product or service greatly alters due to variations in its price.

Marginal Revenue

The extra revenue produced by the sale of an additional unit of a product or service.

Relatively Elastic

A characteristic of a good or service with a demand that is sensitive to changes in price, meaning that small changes in price lead to larger changes in quantity demanded.

Marginal Revenue

The surplus earnings obtained from the sale of one extra unit of a product or service.

Q7: Debits increase asset accounts and decrease liability

Q13: The current ratio is given by:<br>A)Current assets

Q40: An example of fraud would be:<br>A)Issuing a

Q56: Why do many companies use one method

Q63: Which of the following is not a

Q74: Interest is capitalized on all purchased assets.

Q77: When converting an income statement from a

Q113: The possibility that the capital markets' focus

Q113: On May 1,the Chris Company borrowed $30,000

Q153: Capitalizing an expenditure rather than recording it