Yu Corporation

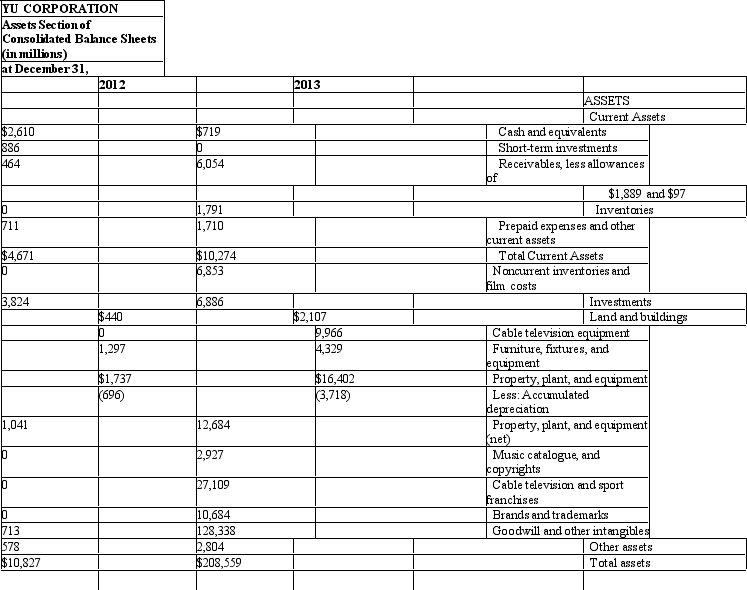

Use the following Assets section of Yu Corporation's balance sheets for the years ended December 31,2013 and 2012 to answer the questions that follow.

Yu Corporation recorded depreciation expense of $344 million for 2012.

Yu Corporation recorded depreciation expense of $344 million for 2012.

Refer to the information for Yu Corporation.

Required:

(1)Explain the impact on net income and cash flows of Yu using straight-line depreciation for financial reporting and accelerated depreciation methods for income tax purposes.

(2)In the notes to the financial statements,Yu indicates that it uses different depreciation methods for different types of plant and equipment assets.Explain why Yu might follow this policy.

Definitions:

Oral Discussion

A verbal exchange of ideas or information between two or more people.

Bilateral Contract

A type of contract involving two parties where each party makes a promise to the other, thus forming mutual obligations.

Uniform Commercial Code

A comprehensive set of laws governing commercial transactions in the United States, intended to standardize regulations across the states to facilitate easier interstate commerce.

Model Code

A systematically arranged collection or compendium of guidelines, rules, or regulations that is designed to serve as a template or reference for legal reform or drafting.

Q1: Acquisition cost is also referred to as:

Q25: In order to evaluate a company's gross

Q35: Which of the following is not an

Q59: Acquisition cost should not include expenditures unrelated

Q63: The solution to this problem requires time

Q78: The party that agrees to repay is

Q86: Satin Corporation The data presented below is

Q101: Enhancing qualitative characteristics of accounting information include

Q123: The accounting system of Carlton and Sons

Q162: Lower Enterprises invested its excess cash in