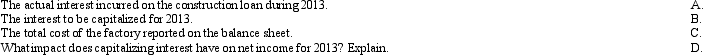

Stately Co.began construction of a new factory at the beginning of 2013.At the end of the year,construction was completed,and construction costs totaled $200,000.Stately borrowed $180,000 at the beginning of 2013 to finance the construction and repaid the loan at the end of 2013.The interest rate on the loan was 9%.Determine the following amounts.

Definitions:

Delayed Credit

A bookkeeping entry signifying credits that will be applied to a customer's account at a future date, affecting future billing cycles rather than immediate revenues.

Delayed Charge

A transaction that records an expenditure which will be billed to a client or customer at a future date, not immediately impacting cash flow.

Pending Expense

Expenditures that have been incurred but not yet fully processed or paid out.

Sales Transaction

A business operation where goods or services are exchanged for money between the seller and the buyer.

Q12: The amount of cash the maker is

Q20: Describe what is meant by unearned revenues

Q52: Zebra Company overstated its December 31,2014 inventory

Q52: Terms of 2/10,n30 mean that if the

Q62: Greeley,Inc.purchased slot machines at the beginning of

Q79: Sarbanes-Oxley requires that the audit committee be

Q147: River Company wants to minimize the amount

Q153: The solution to this problem requires time

Q155: Selling on credit protects a company from

Q159: How would bank service charges be dealt