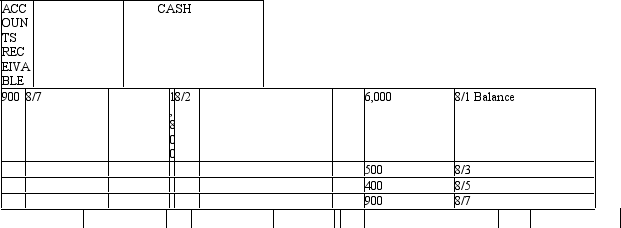

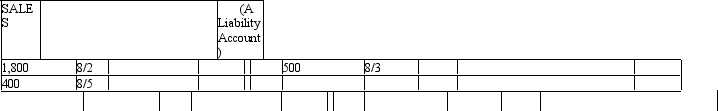

Parachute Country Club Use the selected accounts for Parachute Country Club presented below to answer the following question(s) .

Read the information about Parachute Country Club.

Read the information about Parachute Country Club.

Which of the following describes the transaction which occurred on August 7?

Definitions:

Taxable Income

The amount of an individual's or business's income used to calculate how much tax they owe to the government in a given year.

Total Tax

The annual sum of all taxes owed by an individual or corporation, including federal, state, and local taxes, regardless of deduction or credit eligibility.

Taxable Income

The amount of income that is subject to income tax after deductions and exemptions.

Deductions

Amounts that are subtracted from gross income when calculating taxable income, including expenses, allowances, or specific exemptions.

Q10: Presented below are selected data from the

Q11: The profit margin ratio reflects the amount

Q29: Mountainside Kafe Corporation<br>The following is the consolidated

Q42: Why is the cash basis of accounting

Q91: Cory Harper,a newly hired accountant,wanted to impress

Q94: The amount in the Dividends account should

Q125: Ling Corp.started business at the beginning of

Q137: What is the purpose of a statement

Q138: There is one single format for a

Q173: Use the following information that was obtained