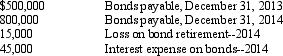

Below is information for Fargo Corp.for 2013 and 2014:  At the end of 2014,Fargo issued bonds at par value for $800,000 cash.The proceeds from these bonds were used to retire the $500,000 bond issue outstanding at the end of 2013 (before their maturity date) .All interest expense was paid in cash during 2014.

At the end of 2014,Fargo issued bonds at par value for $800,000 cash.The proceeds from these bonds were used to retire the $500,000 bond issue outstanding at the end of 2013 (before their maturity date) .All interest expense was paid in cash during 2014.

The following statements describe how Fargo reported the cash flow effects of the items described above on its 2014 statement of cash flows.The indirect method is used to prepare the operating activities section.Which of the following has been reported incorrectly by Fargo?

Definitions:

Shortage Costs

Expenses incurred from inventory deficits, including lost sales and additional costs for expedited shipping.

Adjustment Costs

Expenses incurred in the process of modifying a business operation or strategy, including restructuring or equipment changes.

Transaction Motive

The need to hold cash for the purpose of conducting day-to-day business operations.

Float Management

The practice of managing the time difference between the writing of a check and its clearing at the bank, aiming to optimize the use of available funds.

Q20: The analysis of common-size statements is called

Q40: On January 2,2012,Dock Master Construction,Inc.issued $500,000,10-year bonds

Q47: Stock investors view equity as a claim

Q59: Relevant information can be quantitative or qualitative.In

Q74: St.Petersburg Corporation<br>Use the information obtained from the

Q90: Manatee Company Manatee Company was incorporated as

Q125: Which of the following is an account

Q131: Neville Company issued $100,000 of 6%,10 year

Q142: Which of the following statements regarding bonds

Q175: _ are cash and other assets that