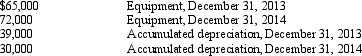

Use the information below for Oakland Inc.for 2013 and 2014 to answer the following question.  During 2014,Oakland Inc.sold equipment with a cost of $30,000 and accumulated depreciation of $25,000.A gain of $3,000 was recognized on the sale of the equipment This was the only equipment sale during the year.

During 2014,Oakland Inc.sold equipment with a cost of $30,000 and accumulated depreciation of $25,000.A gain of $3,000 was recognized on the sale of the equipment This was the only equipment sale during the year.

Assume that all purchases of equipment were paid with cash.How much cash was paid by Oakland for the purchase of equipment during 2014?

Definitions:

Dizygotic Twins

Also known as fraternal twins, these are siblings born at the same time who have developed from two different eggs fertilized by two different sperm, sharing about 50% of their DNA.

Adoption Study

A study that focuses on children who have been reared apart from their biological parents.

Biological Parents

The parents who contribute their genetic material to the offspring through reproduction.

Heritability

The degree to which genetic differences among individuals contribute to their differences in behavior or traits.

Q22: Most investors would prefer to see equity

Q47: Penny's Cafe began operations on March 1,2012.The

Q71: Which one of the following subtotals or

Q75: Which of the following best describes the

Q82: The Financial Accounting Standards Board created the

Q173: Use the following information that was obtained

Q174: Under certain conditions,an investment in common stock

Q179: Significant noncash transactions are not reported on

Q194: Most companies<br>A)are not concerned with the management

Q213: Presented below are selected data from the