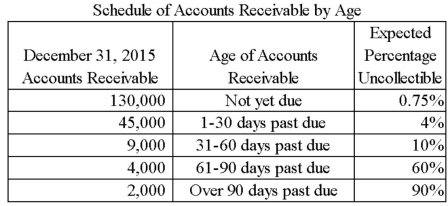

S & R Company uses the aging of accounts receivable approach to estimate bad debt expense.On December 31,2015,an analysis of accounts receivable revealed the following:  Required:

Required:

(a)Calculate the amount of allowance for doubtful accounts that should be reported on the balance sheet at December 31,2015.

(b)Calculate the amount of bad debts expense that should be reported on the 2015 income statement,assuming that the balance of Allowance for Doubtful Accounts on January 1 was $44,000 (credit balance)and accounts receivable written off during the year totaled $49,200.

(c)Present the appropriate general journal entry to record bad debts expense on December 31,2015.

(d)Show how accounts receivable will appear on the balance sheet at December 31,2015.

Definitions:

Fissures

Narrow openings or splits in structures, often referring to cracks in the earth's surface or grooves in biological organs.

Left-handed

The characteristic of using the left hand more skillfully and naturally for tasks such as writing and eating.

Dyslexia

A learning disorder marked by difficulty reading due to problems identifying speech sounds and learning how they relate to letters and words.

Autism

A developmental disorder characterized by difficulties with social interaction and communication, and by restricted and repetitive behavior.

Q1: From the point of view of an

Q5: A perpetual inventory system:<br>A) Gives a continuous

Q5: Accounts receivable accounts for specific customers are

Q11: Quinn paid $440,including GST,for advertising.The entry

Q17: If beginning inventory was $10 000,purchases during

Q17: Management must include which of the following

Q26: R_ entries are made on the first

Q28: The assumption which requires transactions to be

Q36: Merchandise inventory is:<br>A) Reported on the balance

Q52: The FIFO method assumes that costs for