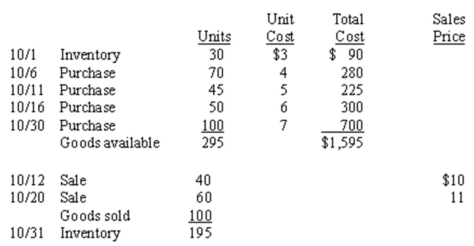

Normandy Company has collected the following inventory data prior to preparing financial statements for the month of October.All purchases and sales are on credit.  Assuming the periodic inventory system is used,determine the cost of the ending inventory and cost of goods sold using FIFO.

Assuming the periodic inventory system is used,determine the cost of the ending inventory and cost of goods sold using FIFO.

Prepare the appropriate journal entries to record:

(A)The October 6 purchase.

(B)The October 12 sale.

(C)The entries to close the October income statement items to Income Summary.(Assume that sales revenue and the elements of cost of goods sold are the only income statement items.)

Definitions:

Wrongful Dissociation

The inappropriate withdrawal of a partner from a partnership, which can lead to damages against the departing partner for breach of the partnership agreement.

Judicial Dissociation

The process by which a court may remove a member from a limited liability company (LLC) based on legal grounds.

Winding Up

The process of concluding a business's operations and distributing its assets to claimants, typically as part of liquidation or in preparation for dissolution.

Transferable Partnership Interest

The right of a partner to transfer their share of the partnership's profits, losses, and distributions to another party, subject to the terms of the partnership agreement.

Q14: A subsidiary ledger is a listing of

Q33: Identify and explain the reasons for the

Q34: Equipment,inventory,and investments may also need subsidiary ledgers.

Q72: The first step in the accounting cycle

Q75: The first step in the accounting cycle

Q87: Internal control policies and procedures are standard

Q94: Notes receivable do not require a subsidiary

Q103: For a merchandising company using the perpetual

Q115: The closing process resets _,_,and _ account

Q171: A contra account is an account the