After preparing an unadjusted trial balance at year-end,the accountant for Chu Design Company discovered the following errors:

(1)The payment of the $225 telephone bill for December was recorded twice.

(2)The payment of a $1,000 note payable was recorded as a debit to Cash and a debit to Notes Payable.

(3)A $900 withdrawal by the owner was recorded to the correct accounts as $90.

(4)An additional investment of $5,000 by the owner was recorded as a debit to

G.Chu,Capital and a credit to Cash.

(5)A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

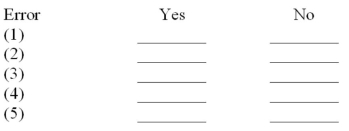

Using the form below,indicate if each error would cause the trial balance to be out of balance.

Would the error cause the trial balance to be out of balance?

Definitions:

Employer's Indorsement

A statement or annotation made by an employer on a document or instrument, often relating to the verification of employment or the endorsement of employee capabilities.

Restrictive Indorsement

An endorsement on a negotiable instrument, such as a check, that limits how the instrument can be used or who can receive it.

Contract Liability

The legal obligation that arises from entering into a contract, where parties are bound to fulfill the terms of the contract.

Warranty Liability

The legal obligation of a seller to compensate the buyer for defects or issues in the sold product or service that were guaranteed against in a warranty.

Q35: The accounting principle that requires revenue to

Q36: A debit is used to record:<br>A) An

Q40: A transaction that decreases an asset account

Q45: A study of Latinos with arthritis found

Q46: Findings from the Trials of Hypertension Prevention

Q62: Chuck Taylor withdrew $6,000 in cash for

Q64: "Bookkeeping" is another term for "accounting".

Q78: To make it easier for the bookkeeper,the

Q81: On October 15,Gallery Corp.received $12,500 as a

Q216: Prepare a balance sheet in good form