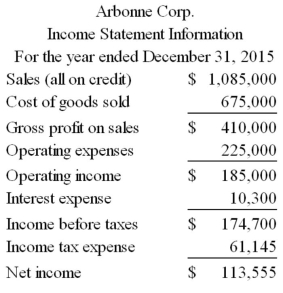

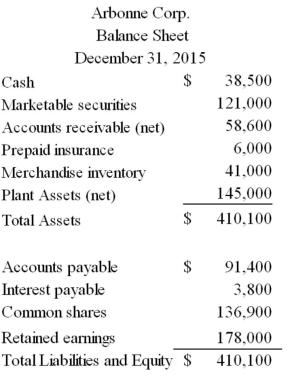

Given the following information from the current financial statements of Arbonne Corp,calculate the ratios listed below the financial statements.

(A)Current ratio.

(A)Current ratio.

(B)Accounts receivable turnover.

Assume the beginning of year accounts receivable balance was $59,500.

(C)Days' sales uncollected.

(D)Merchandise turnover.

Assume the beginning of year merchandise inventory was $50,200.

(E)Times interest earned.

(F)Return on common shareholders' equity.

Assume the beginning of year common shares balance was $180,000 and retained earnings was $128,000.

(G)Earnings per share (assume Arbonne Corp's average common shares outstanding is 50,000).

(H)Price-earnings ratio.

Assume the company's shares are selling for $26 per share.

Definitions:

Discount Rate

The discount rate is the interest rate used in discounted cash flow analysis to determine the present value of future cash flows.

Salvage Value

The predicted remaining value of an asset at the termination of its functional life.

Working Capital

The amount by which current assets exceed current liabilities, indicating the liquidity level available to a business for day-to-day operations.

Salvage Value

The calculated resale value an asset holds once it ceases to be useful.

Q32: Music City had net income of $43,000,net

Q36: The statement of cash flows is:<br>A) Another

Q82: The increase or decrease in cash equals

Q97: Accounts receivable turnover measures:<br>A) How often a

Q105: Which of the following is true of

Q117: Investments in associates are reported as _

Q130: The receipt of cash dividends from a

Q142: Dividend yield is calculated by dividing annual

Q218: Explain return on total assets and how

Q228: Phoenix Corp had net income of $145,500,net