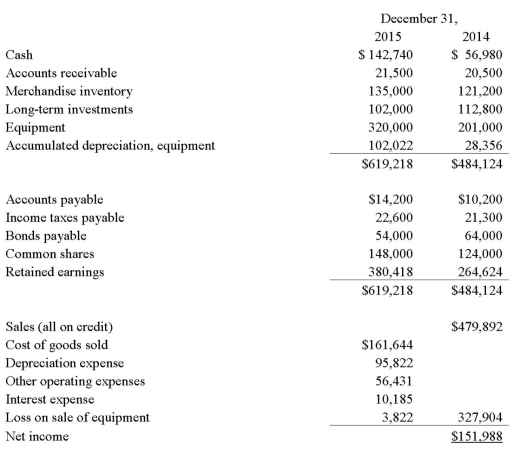

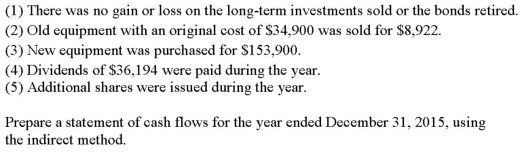

Perry Corp had the following financial data related to the years ended December 31:

Definitions:

Regressive

Describing a tax system where the tax rate decreases as the taxpayer’s income increases, placing a larger burden on lower-income individuals.

Taxable Income

Taxable income is the portion of your gross income that's subject to taxes after deductions and exemptions.

Tax Liability

The total amount of tax owed to the government after all deductions, credits, and prepayments have been taken into account.

Tax Refund

The amount of money returned to a taxpayer by the government when the taxpayer's total tax payments exceed their tax liability for a given year.

Q3: The appropriate statement of cash flows activity

Q56: For each of the following independent situations,present

Q60: Three of the most common tools of

Q78: A share dividend is not a liability

Q108: On January 5,2015,Erin Ridge Corp.purchased 28,000 shares

Q129: On December 31,2015,Jenna Corp issued $1,000,000,8%,5-year bonds.Interest

Q154: Fisher Corporation leases photocopy equipment from Jonah

Q228: Phoenix Corp had net income of $145,500,net

Q296: Brown Company has net income of $125,000.Its

Q332: Chevron paid $2.10 in common dividends per