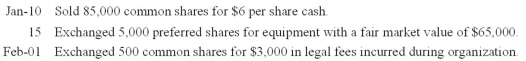

Sheryl Inc.is authorized to issue 70,000,$9,cumulative preferred shares,and 750,000 common shares.Prepare journal entries to record the following transactions that occurred during the first year of operations:

Definitions:

Producer Surplus

The difference between the amount producers are willing to supply a good for and the actual amount they receive when the good is sold.

Producer Surplus

The gap highlighting the difference between the initial asking price by sellers for goods or services and the ultimately received price.

Specific Tax

A tax that is levied as a fixed amount per unit on a particular good or service.

Inelastic Demand

A situation where demand for a product or service is relatively unmoved or less sensitive to changes in price.

Q16: According to the activity-based costing system, what

Q38: All expected future payments are liabilities.

Q52: If a partnership contract provides for interest

Q79: Explain the type of information needed to

Q84: Explain the difference between an income statement

Q88: Land improvements are:<br>A) Assets that increase the

Q91: Changes in investment values are recognized with

Q95: Net incomes or losses are recorded in

Q105: Use the following information to prepare Macie

Q130: You graphed periodic interest expense and cash