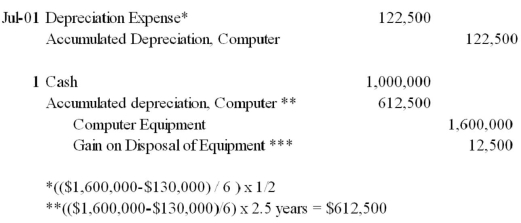

Danner Co.purchased a computer on January 1,2014,for $1,600,000.The straight-line method of depreciation was used,based on an expected life of 6 years and a residual value of $130,000.Prepare the journal entries to record depreciation for the first 6 months of 2016 and the sale of the computer on July 1,2016,for $1,000,000.

Definitions:

Medical Science

The branch of science focused on the study, diagnosis, treatment, and prevention of diseases and the promotion of human health.

Property Interest

A legal right or claim to property, including ownership, use, or investment stakes.

Enforceable

Capable of being imposed or carried out by legal process or by force; applicable to obligations or contracts that can be legally compelled.

Contract of Adhesion

A standard-form agreement prepared by one party, with the other party having little to no ability to negotiate more favorable terms.

Q1: On June 14,Cool Sports gave a 90-day

Q6: Problem 2<br>The cost of making component Q

Q21: Kendall Company has sales of 1,000 units

Q45: In an income statement prepared as an

Q45: Compare and Contrast the costing systems for

Q48: Explain the differences between Committed and Discretionary

Q55: Beta Inc.had the following equity as of

Q63: Unearned revenues are amounts received _.

Q69: Recording provisions is required when it is

Q108: The cost of land can include:<br>A) Purchase