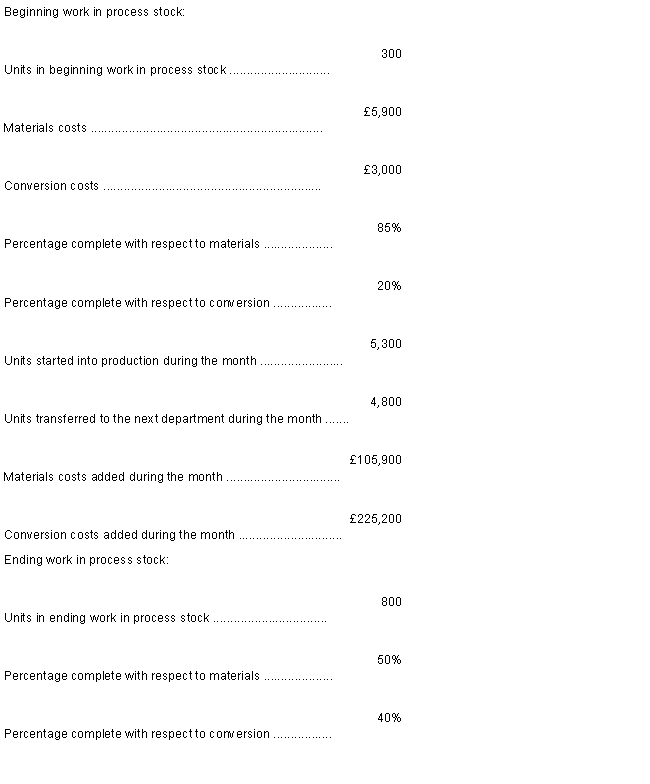

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. According to the company's records, the conversion cost in beginning work in process stock was £92,218 at the beginning of June. Additional conversion costs of £571,618 were incurred in the department during the month.

What was the cost per equivalent unit for conversion costs for the month? (Round your answer to three decimal places) .

Definitions:

Dependent Variable

The variable in an experiment or model that is assumed to depend on one or more independent variables.

Coefficient of Correlation

A metric that evaluates the degree and angle of a direct correlation between two quantities.

Coefficient of Determination

A statistical measure, often denoted as R-squared, that represents the proportion of the variance for a dependent variable that's explained by an independent variable or variables in a regression model.

Linear Regression

A statistical method for modeling the relationship between a dependent variable and one or more independent variables using a linear equation.

Q3: Note: Your answers may differ from those

Q10: Depreciation is usually recorded:<br>A) From the beginning

Q16: The amount of direct materials cost in

Q33: Last year Easton Company reported sales of

Q45: Explain the advantages and limitations of using

Q57: If the business unit in Italy plans

Q58: Both job order and process costing systems

Q60: Paulson Company uses a predetermined overhead

Q66: In this decision the sunk costs are:<br>A)£20,000.<br>B)£100.<br>C)£200.<br>D)£300.

Q130: Each year goodwill is examined to see