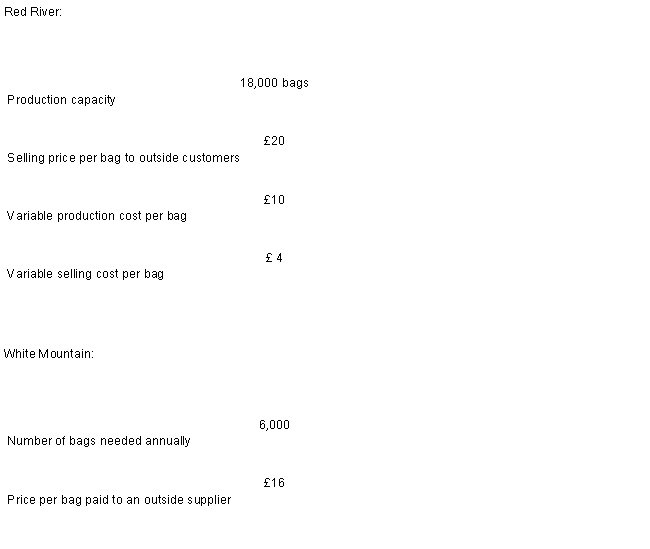

The Red River Division of Alto Company produces and sells bags of pottery clay that can either be sold to outside customers or transferred to the White Mountain Division of Alto Company. The following data are available from the last year:

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

-If Red River can sell 15,000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

Definitions:

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the cost of a product.

Pricing

The process of determining the value at which goods or services will be sold, often considering factors such as production costs, market demand, and competition.

Absorption Costing

An accounting method that includes all manufacturing costs - direct labor, materials, and overhead - in the cost of a product.

Long-term Sales

Transactions or sales contracts that are expected to be fulfilled over an extended period of time.

Q1: In a process cost system, the application

Q6: <br>TQM/BPR are management accounting techniques with the

Q8: Variable costs are costs that vary, in

Q16: Healthy People 2010 lists communicable disease as

Q23: Ultimately most companies exist to provide financial

Q32: The higher the denominator level of activity<br>A)the

Q42: The materials price variance should be computed

Q59: If the FIFO cost method is being

Q61: The job cost sheet is used in

Q64: If a production process is set up