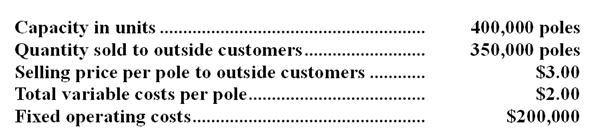

The Pole Division of Hillyard Company produces poles which can be sold to outside customers or transferred to the Flag Division of Hillyard Company. Last year the Flag Division bought 50,000 poles from Pole at $2.50 each. The following data are available for last year's activities in the Pole Division:  In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division.

In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division.

-Suppose that last year an outside supplier would have been willing to provide the Flag Division with the basic poles at $2.10 each.If Flag had chosen to buy all of its poles from the outside supplier instead of the Pole Division,the change in net operating income for the company as a whole would have been:

Definitions:

Net Income

The total earnings of a company after subtracting all expenses, including taxes, from its total revenues.

Indirect Method

Indirect Method is a way of preparing the cash flow statement where net income is adjusted for non-cash transactions, changes in working capital, and other items to calculate cash flow from operating activities.

Operating Activities

Operating Activities involve the primary day-to-day actions related to producing and delivering a company's products or services, influencing cash flow and operating income.

Net Income

The total earnings of a company after all expenses and taxes have been subtracted from total revenue.

Q13: Snappy's manufacturing overhead for the year was:<br>A)£10,250

Q14: Discuss interactive control systems and their use

Q21: Lean enterprises avoid confrontation<br>

Q24: The required rate of return is the

Q27: The Occupational Safety and Health Administration does

Q30: The cost of goods manufactured (finished) for

Q41: Some of the bases of budget criticism

Q48: The first steps to planning are not

Q49: Improving manufacturing flow lines is not relevant

Q66: In practice, how practical is it to