The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

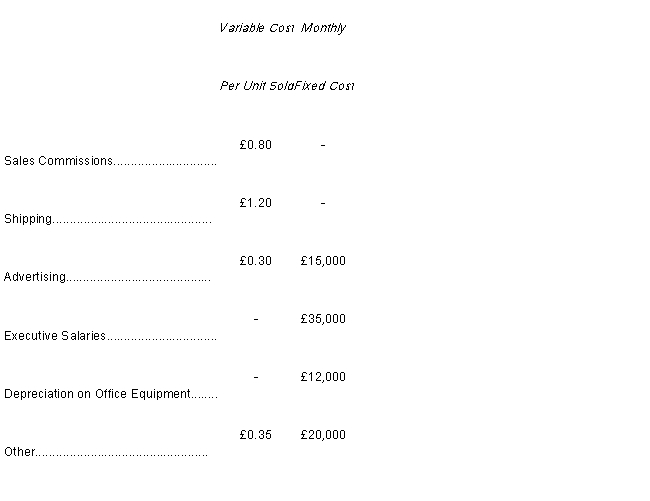

French Division Cost Structure

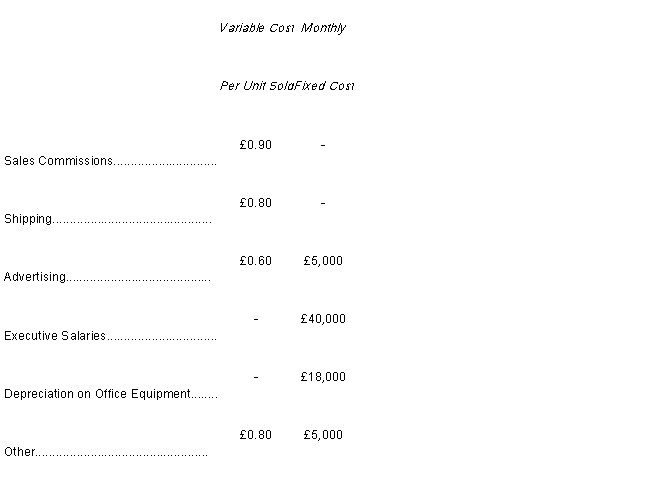

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell an additional 2,000 units in July (27,000 in total) , then the total budgeted selling and administrative expenses would increase by

Definitions:

Capital Intensity Ratio

A measure of the amount of capital needed per dollar of revenue, indicating the investment required for a company to maintain its current level of production.

Full Capacity

The maximum level of output that a company can sustain over a period of time without increasing the production resources.

Long-term Debt

Borrowings or financial obligations that are due for repayment over a period longer than one year.

Capital Intensity Ratio

A financial measure that indicates the amount of assets or capital required to generate a dollar of revenue, illustrating the capital efficiency of a company.

Q1: Target pricing is useful companies that have

Q2: Which of the following statements accurately reflects

Q4: The greatest risk factor for suicide in

Q9: The Khaki Company has the following

Q12: Substance abuse among adolescents is influenced most

Q19: Medicare places emphasis on:<br>A) Chronic care<br>B) Distributive

Q20: Budgeting has not been criticised as<br>A)mechanistic<br>B)encourages gaming<br>C)unable

Q26: The cost of capital involves a blending

Q44: In the long run constraints can be

Q58: The material price variance is computed by