Greenwich plc is considering adding two new products at a subsidiary to improve its overall competitiveness. The new products are enthusiastically supported by the managers responsible and an immediate decision is required. It is normal for the managers to calculate the net present value (NPV) for the projects before it is accepted or rejected.

Details of the proposals

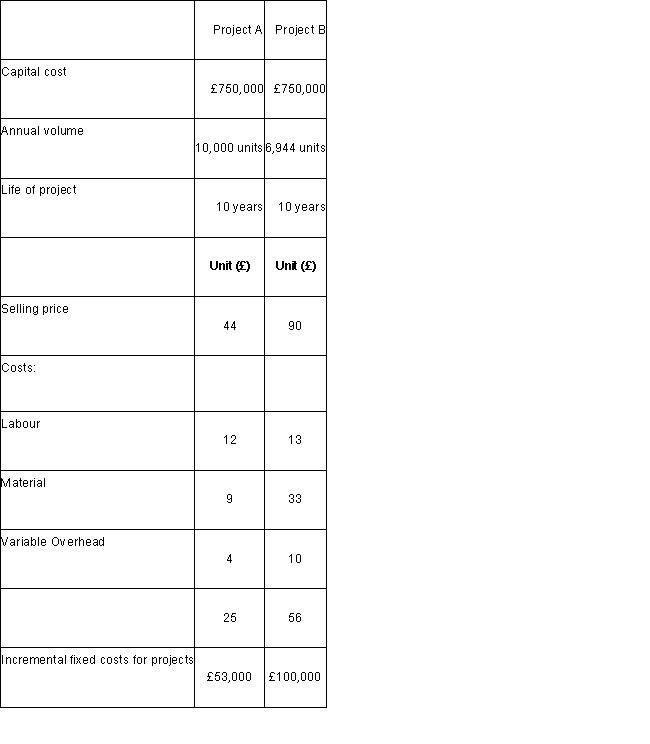

-

Calculate the relevant annual cash flow for Project A

Definitions:

Itemized Deductions

Specific expenses that taxpayers can claim to reduce their taxable income, as opposed to taking the standard deduction.

Charitable Contributions

Donations or gifts given by individuals or organizations to non-profit organizations, which can often be deducted from taxes.

AGI Limitation

Restrictions or phase-outs on certain tax deductions, credits, or exemptions based on the taxpayer's Adjusted Gross Income (AGI).

Churches

Religious organizations that may enjoy certain tax exemptions and benefits under IRS guidelines.

Q1: One of the best methods an occupational

Q5: Calculate the relevant cash flows for year

Q9: Managers should exercise considerable care in their

Q14: A company has a standard cost system

Q19: <br>Assume that the accounts receivable balance on

Q21: Methicillin resistant S. aureus (MRSA) is still

Q21: Which of the following roles is the

Q25: Which of the following statements about a

Q27: Which of the following overhead variances

Q41: From the point of view of the