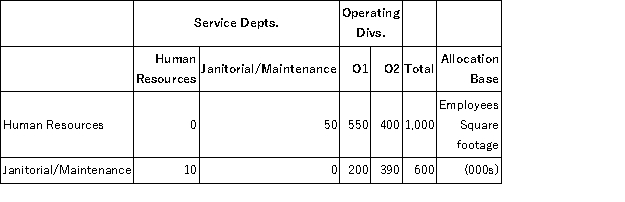

IFLAX manufactures commercial brushes in two operating divisions (O1 and O2) and has two service departments (Human Resources and Janitorial/Maintenance). The two service departments' costs are allocated to the two operating departments. Human Resources' costs of $600,000 are allocated based on the number of employees, and Janitorial/Maintenance costs of $800,000 are allocated based on square footage. The following table summarizes the number of employees and the square footage in each division and department.  Required:

Required:

a. Allocate the costs of the two service departments to the two operating divisions using the direct allocation method.

b. Allocate the costs of the two service departments to the two operating divisions using the step-down allocation method where Human Resources is allocated first and Janitorial/Maintenance is allocated second.

c. Allocate the costs of the two service departments to the two operating divisions using the step-down allocation method where Janitorial/Maintenance is allocated first and Human Resources is allocated second.

d. Compute the Human Resource Department cost per employee under the three allocation methods (direct allocation, step-down allocations where Human Resources is first, and the step-down method where Janitorial/Maintenance is first).

e. Compute the Janitorial/Maintenance cost per square foot under the three allocation methods (direct allocation, step-down allocations where Human Resources is first, and the step-down method where Janitorial/Maintenance is first).

f. Briefly discuss the various factors IFLAX management should consider in choosing how to allocate the two service department costs to the two operating divisions.

Definitions:

Debt

An amount of money borrowed by one party from another, under the condition that it is to be paid back at a later date, usually with interest.

Tax Rate

The share of profits or income that individuals or companies must pay to the government as taxes.

Market-To-Book Ratio

A financial ratio that compares a company's market value to its book value, used to evaluate whether a stock is under or overvalued.

WACC

The Weighted Average Cost of Capital is a method used to determine a company's capital cost, where each type of capital is weighted according to its proportion.

Q6: The definition of a derivative requires which

Q8: Barrington Bears has developed the following sales

Q10: Pamela in Bamplona makes bull-repellent scent according

Q12: CC uses absorption (full) costing and its

Q13: Which of the following assets is regarded

Q14: Peluso Company, a manufacturer of snowmobiles, is

Q14: Under IAS 2 Inventories, items of inventory

Q26: Which of the following is not a

Q34: According to IDEA 2004, the diagnosis of

Q45: A teacher analyzes the classroom assignments of